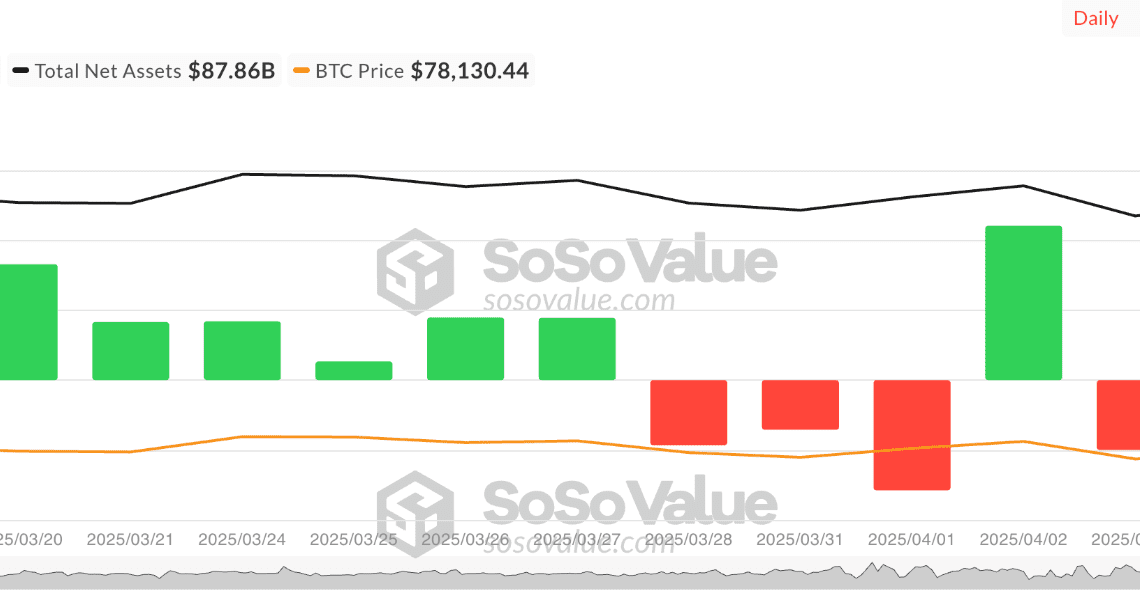

YEREVAN (CoinChapter.com) — Spot Bitcoin ETF outflows reached $109.21 million on Monday, April 7, according to SosoValue. This marked the highest single-day net outflow in the last seven days. No spot Bitcoin ETF reported any net inflow during the day.

Grayscale’s GBTC led with $74.01 million in net outflows. Its assets under management (AUM) fell to $22.70 billion. The BTCO ETF by Invesco and Galaxy Digital recorded the second-largest withdrawal of $12.86 million. Its total historical net inflow remains $85.32 million.

All twelve U.S. spot Bitcoin ETFs posted zero inflows. The data reflects a wide pullback from institutional investors following the $1 billion weekend liquidation across crypto markets.

Bitcoin Futures Open Interest Falls Despite 3% Price Gain

As of press time, Bitcoin futures open interest stood at $50.95 billion, down 2% from the previous day, according to Coinglass. At the same time, Bitcoin’s price rose by 3%.

This drop in Bitcoin futures open interest during a price increase points to short-covering. In such cases, traders close existing short positions, which can push prices up temporarily.

The absence of rising open interest alongside the price gain indicates the market is not seeing new long positions. This aligns with broader caution seen across ETF data.

The Bitcoin funding rate stayed positive throughout the same period, based on Coinglass data. Traders holding long positions continued to pay funding fees. This typically occurs when long positions outnumber shorts in perpetual futures contracts.

A steady positive funding rate suggests that traders have not closed long positions in large numbers. It also shows that the futures market still has participants maintaining exposure, even without new leverage being added.

The funding rate did not rise sharply but stayed at stable levels. This reflects a market leaning slightly bullish in structure but without aggressive new entries.

Bitcoin ETF Outflows = Put Contracts Rise in Options Market

According to Deribit, BTC put contracts increased in open interest. This trend reflects positioning for potential downside risk. Puts give traders the right to sell BTC at a set price and are often used for hedging.

The growth in BTC put contracts signals that more traders are preparing for price drops. This rise in defensive positioning aligns with the lack of ETF inflows and falling futures open interest.

Deribit options data shows a clear shift toward risk management. Investors are allocating more toward puts than calls, reflecting a conservative stance in the current environment.

The combination of Bitcoin ETF outflows, falling Bitcoin futures open interest, stable Bitcoin funding rate, and rising BTC put contracts suggests a cautious start to the week. The spot market failed to attract capital, while derivatives markets showed risk-off signals.