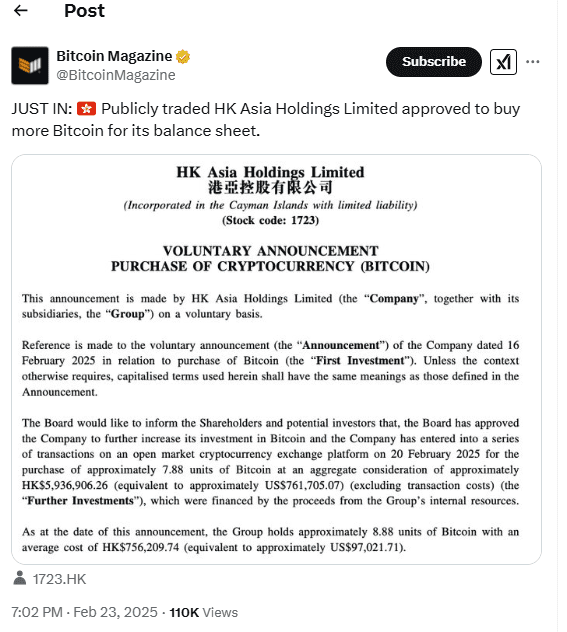

YEREVAN (CoinChapter.com) — HK Asia Holdings Limited has expanded its Bitcoin investment, acquiring 7.88 BTC for $761,705 on Feb. 20. The board approved the purchase, bringing the firm’s total Bitcoin holdings to 8.88 BTC. The average cost per Bitcoin now stands at $97,021, valuing the total holdings at approximately $861,500.

The company made its first Bitcoin acquisition on Feb. 16, marking a shift in its investment approach. The latest Bitcoin purchase also adds to the growing trend of companies holding digital assets.

HK Asia’s Stock Price Rises After Bitcoin Strategy Shift

If the trend continues, HK Asia’s stock could surpass its June 2019 peak of 6.50 Hong Kong dollars ($0.84). The stock has already increased 1,700% in 2025, reflecting the market’s reaction to the Bitcoin investment.

HK Asia Funds Bitcoin Purchases with Internal Resources

The company financed the Bitcoin acquisition using internal resources. The board cited the growing adoption of Bitcoin in commercial markets as a reason for the investment.

HK Asia voluntarily disclosed the transaction, despite it falling below the required disclosure threshold. This follows the trend of public companies investing in Bitcoin as part of their corporate treasury strategy.

MicroStrategy Continues to Lead in Bitcoin Holdings

Interestingly, several public companies have increased their Bitcoin holdings in recent years. MicroStrategy, now called Strategy, remains the largest corporate Bitcoin holder. The firm announced plans to raise $2 billion through 0% senior convertible notes to buy more Bitcoin.

Strategy currently holds 478,740 BTC, worth approximately $47 billion. The company’s Bitcoin purchase price averages $65,000 per BTC. The Bitcoin investment has led to a 51% profit, with Strategy’s stock rising 360% over the past year.

Notably, company founder Michael Saylor has stated that Bitcoin and artificial intelligence will shape future markets. Strategy’s approach reflects an increasing trend of corporations adopting Bitcoin as a treasury asset.

BTC Price Holds Below $100,000 Amid Market Resistance

U.S. States and Companies Increase Bitcoin Exposure

Moreover, governments and corporations continue to adopt Bitcoin. Several U.S. states, including Illinois, Kentucky, Maryland, New Hampshire, New Mexico, North Dakota, Ohio, Pennsylvania, South Dakota, and Texas, have introduced bills that could allow them to hold Bitcoin and other cryptocurrencies.

In addition, other companies have also expanded their Bitcoin investments. Metaplanet recently purchased 68.59 BTC for about $6.6 million, adding to the increasing number of firms integrating Bitcoin into their financial strategies.

The post HK Asia Expands Bitcoin Holdings, Buys 7.88 BTC for $761,705 appeared first on Coinchapter.

%%featured_image%%