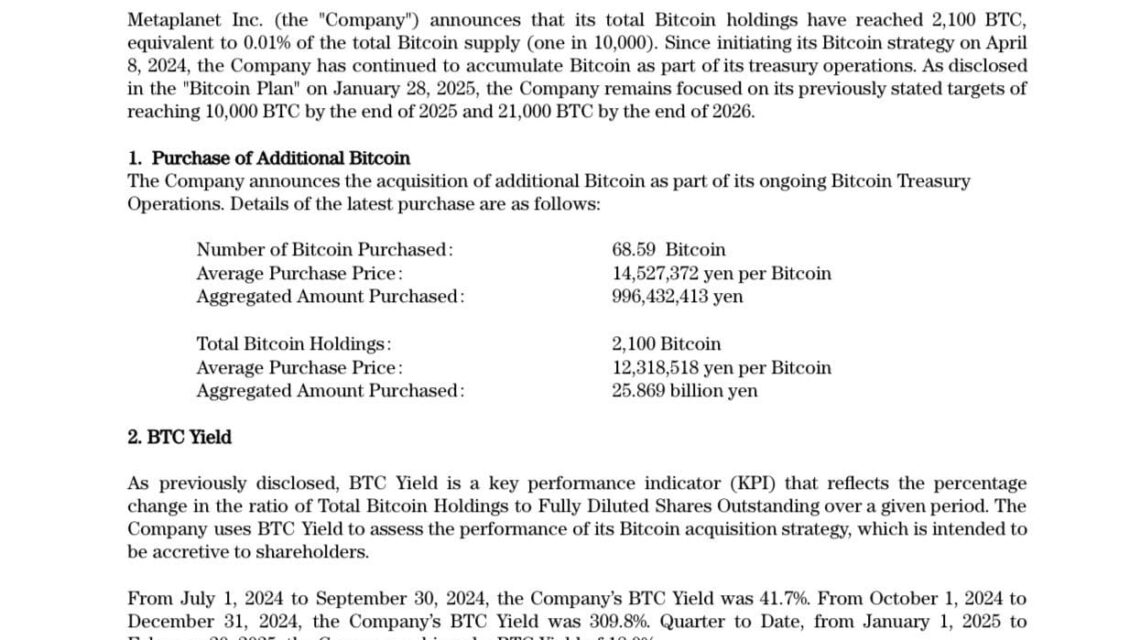

YEREVAN (CoinChapter.com) — Metaplanet, a Japanese investment firm, has acquired an additional 68.59 BTC, spending approximately $6.6 million. The company purchased Bitcoin at an average price of $96,335 per BTC, increasing its total holdings to 2,100 BTC.

At the current market rate, Metaplanet’s Bitcoin holdings are worth around $203 million. The company, listed on the Tokyo Stock Exchange, started its Bitcoin investment strategy in April 2024 and has continued to increase its Bitcoin portfolio.

Metaplanet Plans to Reach 10,000 BTC by 2025

Metaplanet has set a target to accumulate 10,000 BTC by the end of 2025 and 21,000 BTC by 2026. To support this goal, the company issued 21 million shares of zero-discount stock acquisition rights to EVO FUND under its 21 Million Plan.

With the latest Bitcoin purchase, the company has achieved 2.38% of its Bitcoin accumulation target. Metaplanet’s Bitcoin strategy is focused on long-term growth, using structured financial mechanisms to expand its Bitcoin reserves.

Metaplanet Stock Climbs 80.75% in 2025

After the latest Bitcoin investment, Metaplanet’s stock closed 2.78% higher at 6,290 yen on Thursday, according to Yahoo Finance. Despite the Nikkei 225 index declining 1.24% on the same day, the company’s shares have increased 80.75% in 2025.

Over the past six months, Metaplanet’s stock price has risen 427.24%. Since shifting its focus to Bitcoin acquisition, the stock price has grown 3,600%, making it one of Japan’s strongest-performing stocks in the market.

Stock Split Expands Market Participation

In February, Metaplanet completed a 10-for-1 stock split, increasing the total number of issued shares from 39.1 million to 391.6 million. The company said the split was intended to improve market participation by making shares more accessible.

Earlier, in August 2024, Metaplanet had executed a reverse stock split, consolidating 10 shares into one after significant stock price growth. The company has adjusted its share structure multiple times in response to Bitcoin-related stock price movements.

Strategy Raises $2 Billion for Bitcoin Acquisitions

Several U.S. states are also exploring Bitcoin adoption as a reserve asset. Illinois, Kentucky, Maryland, New Hampshire, New Mexico, North Dakota, Ohio, Pennsylvania, South Dakota, and Texas have introduced bills to integrate Bitcoin into their financial systems.

Additionally, state pension funds and treasuries across 12 U.S. states have invested in Strategy’s stock, holding a total of $330 million worth of shares as of the end of 2024. California’s State Teachers Retirement System holds the largest stake, owning 285,785 shares valued at $83 million, according to a February 14 SEC filing.

The post Metaplanet Increases Bitcoin Holdings with $6.6M Purchase, Now Holds 2,100 BTC appeared first on Coinchapter.

%%featured_image%%